Crypto tax Guide 2025

The crypto market's future may be unpredictable, and regulations are constantly evolving. But after surpassing a $3.5 trillion global market cap in 2024, one thing's for sure...

#1 cryptocurrency tax software and portfolio tracking appJoin 3 million people who use CoinTracker, the #1 cryptocurrency tax software and portfolio tracking app

File in 5 minutes with 500+ integrations & maximize tax savings

SECURITY AT EVERY STEP

With read-only access to your wallets, end-to-end encryption, and token based two-factor authentication, your data is in safe hands

Sync all your crypto transactions from over 500+ wallets and exchanges. With our industry-leading integrations, all your data is in one secure place, automatically.

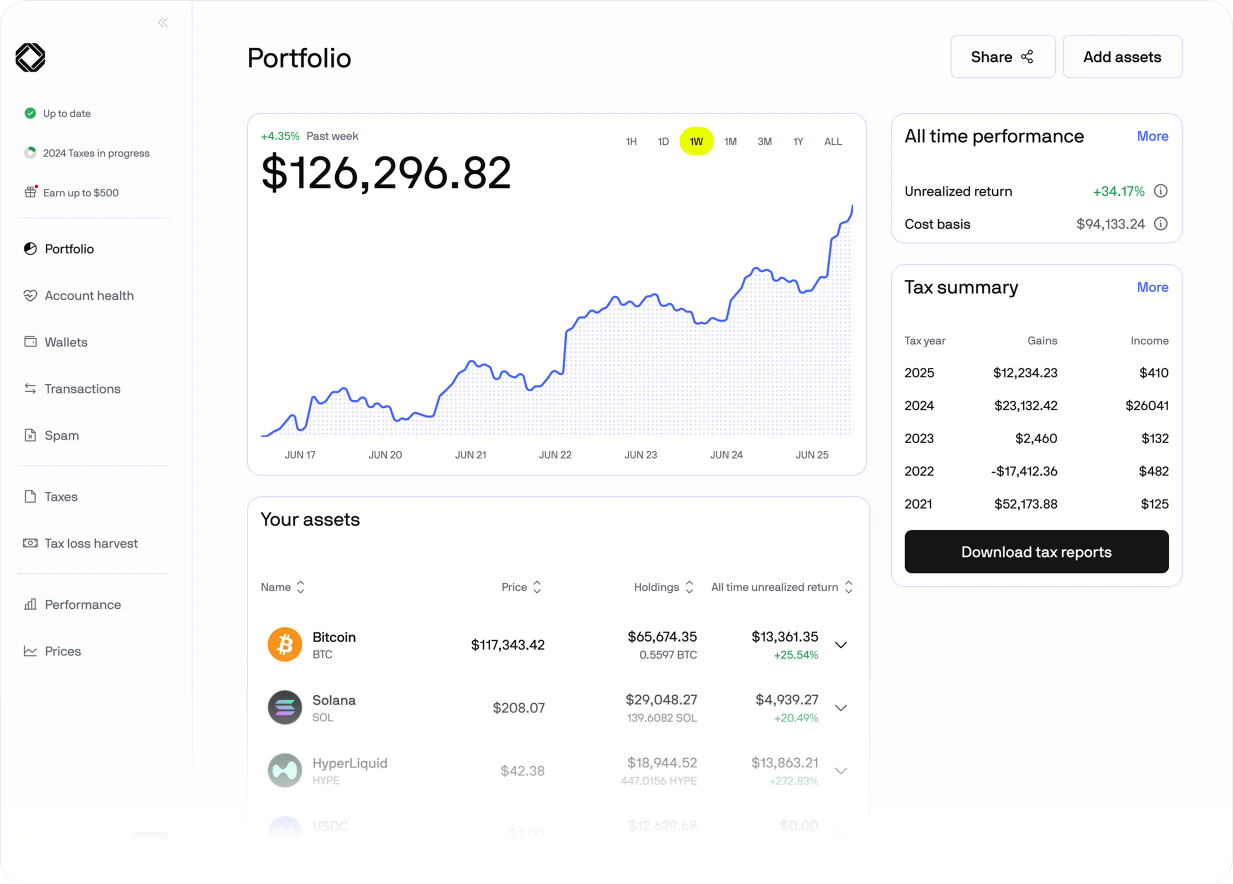

Get a clear, real-time overview of your crypto performance. See your portfolio value, track gains and losses, and understand your tax liability with easy-to-read charts and insights.

Click, create and download all the necessary tax forms, including IRS Form 8949. Maximize your tax savings with features like tax-loss harvesting. You can even file directly with TurboTax or H&R Block.

Track all your crypto, all in one place, with our free crypto portfolio tracker. Support for the most popular exchanges and wallets, 50k+ smart contracts, 600+ dapps, and more.Track all your crypto, all in one place, with our free crypto portfolio tracker. Support for the most popular exchanges and wallets, 50k+ smart contracts, 600+ dapps, and more.

what our customers are saying

The crypto market's future may be unpredictable, and regulations are constantly evolving. But after surpassing a $3.5 trillion global market cap in 2024, one thing's for sure...

Coinbase aims to simplify crypto spending with its debit card. But is Coinbase Card truly advancing crypto adoption, and who’s eligible to use it?

Looking for legit ways to get free Bitcoin? Discover real, tested methods—from cashback rewards to airdrops—that actually work in 2025, and learn how to avoid common scams.

Yes, the IRS enforces capital gains tax on cryptocurrencies by classifying them as property, not currency. This means crypto sales, trades, or purchases are taxed under standard investment tax rules—either as short-term gains (taxed as income) or long-term gains (lower tax rates if held >1 year).

Want to learn more about 2025 crypto taxes? Explore our blog